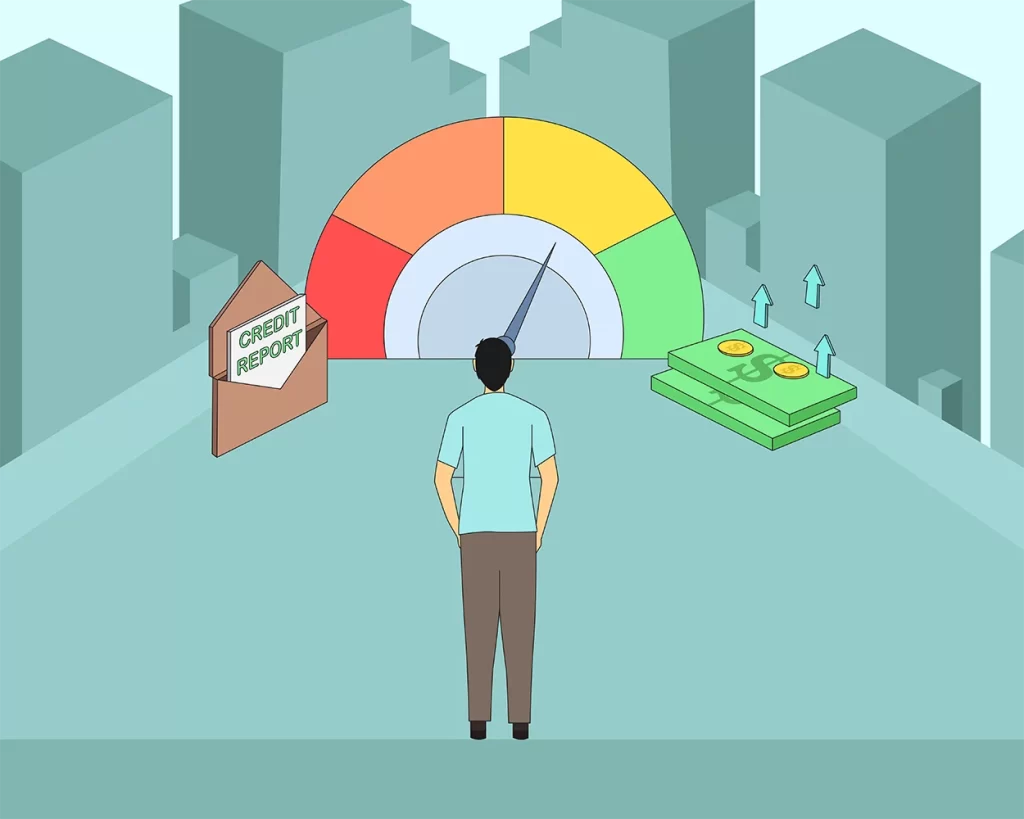

A credit score chart is what creditors look at to see if you are in good standing or not. This helps them decide whether or not to lend you money that you need to buy a car, a house or pay for tuition.

Because it does not take into account gender, race, religion, martial status or national origin, it is fair. What they use as basis is your behavior over the past few years. They will look into your credit history to see if you have any debts or outstanding loans, lines of credit and how long have you been given credit.

There is a certain percentage on each of them so if you don’t do well in one, there is a chance that you could improve on this in the others.

The one that is used by credit agencies is the FICO score and this information is available to you and to the lender.

The credit score chart is from 300 to 850. Majority of Americans score above 700, which is good and makes it easy for them to get credit and even waive a deposit. A small number don’t do well and they have to work hard to improve it.

Keep in mind that the credit score chart is just numbers. They don’t tell you how to improve your score or maintain it. So, to help you along the way, here are a few things you can do.

- First, pay your bills on time. This comes monthly and you are given time to pay for them so make sure to deposit the amount before the due date to avoid paying penalties.

- Second, decrease your debt. Surely, apart from your monthly credit card bills and utilities, you have may a few loans. Since you applied for these, it is only right that you live up to your end of the bargain by paying these at the agreed upon date.

- Third, if you think having multiple lines of credit is good, think again. Studies have shown that this backfires on the person since they are more at risk of non payment which in the end has a negative effect on your credit score. So, if you don’t need it, don’t even bother and if you do have, get rid of them.

- Fourth, review your credit report. If you have paid your bills and loans on time but your score is not that high, check for errors. Most of the time, you may find one or two things there that are not true. If this is the case, call the crediting agency and send them the supporting documents to prove your case.

The standard protocol here is for the crediting agency to conduct an investigation. If your creditor cannot dispute what you have claimed, then they have to change and a revised copy of the credit report will be sent to you for free.

If you want to get a credit score report for free, look at the different agencies that provide this service and compare them. Some will give you a copy for free while others will ask you to pay a certain amount monthly.

You can also find a credit score chart by going online since this is posted which saves you the trouble of looking at different sites.